Bitcoin Halving Price Prediction 2024

Many analysts and traders are eagerly anticipating the upcoming bitcoin halving, an event where the rate of new Bitcoins issued to network validators, commonly known as miners, is reduced. This event is expected to serve as a catalyst for crypto prices, much like previous halvings have done in the past.

However, there exists a longstanding debate within the crypto community regarding whether these programmatically triggered events are already “priced in” by the market. In other words, some argue that the anticipated impact of the halving on supply and demand dynamics is already reflected in the current price of bitcoin, rendering any potential price surge already accounted for. Conversely, others believe that the halving events create genuine scarcity, driving up demand and subsequently leading to price increases.

As the crypto market eagerly awaits the next bitcoin halving, analysts and traders continue to closely monitor market trends and debate the potential implications for crypto prices.

What is Bitcoin Halving?

The Bitcoin halving is a significant event that takes place approximately every four years or every 210,000 blocks, resulting in a halving of the reward for mining new Bitcoins. This deliberate reduction in the rate of new supply ensures that the total number of Bitcoins in circulation will never surpass 21 million, thereby establishing Bitcoin as a deflationary asset with inherent scarcity.

Beyond its implications for supply dynamics, the halving fundamentally influences Bitcoin’s price dynamics. Historical data demonstrates that Bitcoin typically enters a bull market following each halving event. This is characterized by a sustained period of rising prices. The reduction in the rate of new supply leads to increased demand and a lower inflation rate, which in turn drives prices higher.

In essence, the Bitcoin halving serves as a pivotal moment in Bitcoin’s monetary policy, reinforcing its scarcity and contributing to its value proposition as a store of value and potentially driving significant price appreciation over time.

When is the next halving?

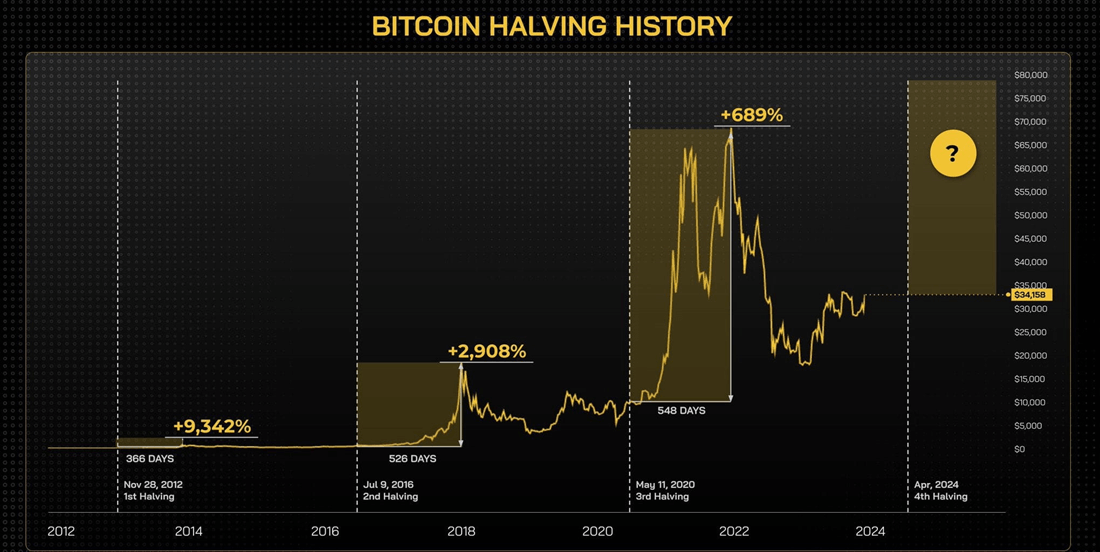

The upcoming Bitcoin halving, scheduled for April 2024, will halve the block reward from 6.25 to 3.125 Bitcoins per block. Based on historical patterns observed in previous halving events, many experts anticipate that this event could trigger another bull market for Bitcoin.

During previous halvings, such as those in 2012, 2016, and 2020, Bitcoin experienced significant price rallies in the months and years following the event. This is largely attributed to the reduction in the rate of new supply, leading to increased scarcity and heightened demand for the cryptocurrency.

As a result, there is widespread speculation among analysts and traders that the upcoming halving could drive Bitcoin’s price to new record highs. However, it’s important to note that market dynamics can be influenced by a multitude of factors, and the future performance of Bitcoin following the halving event remains uncertain.

Does the Bitcoin halving affect the price?

Indeed, every Bitcoin halving has historically had a pronounced effect on the Bitcoin price, driven by two primary factors.

Firstly, the halving reduces the rewards for miners, a mechanism designed to sustainably grow the network until the total supply of 21 million bitcoins is reached. This process ensures that new bitcoins are introduced into the market at a decreasing rate over time.

Secondly, the halving reduces the inflation rate of Bitcoin, as the pace at which new bitcoins are created is slashed with each halving event. This reduction in the rate of supply growth, coupled with growing demand, creates a fundamental imbalance in supply and demand dynamics, typically resulting in upward pressure on the price of Bitcoin.

This fundamental principle of supply and demand underpins Bitcoin’s cyclical price behavior, characterized by distinct phases known as bull markets and bear markets. Leading up to each halving, there is typically a period of approximately two years marked by rising prices, driven by anticipation of the halving event and its impact on supply dynamics. This is followed by a year of sustained high prices, known as a bull market, during which positive price action prevails. Subsequently, a period of low prices, known as a bear market, typically ensues.

Importantly, historical data indicates that each halving event in Bitcoin’s history has been followed by a bull market, highlighting the significance of the halving in shaping Bitcoin’s price trajectory.

LATEST BITCOIN PRICE NEWS

YOU CAN WIN $200 EVERY HOUR